Canada Revenue Agency

Most Requested

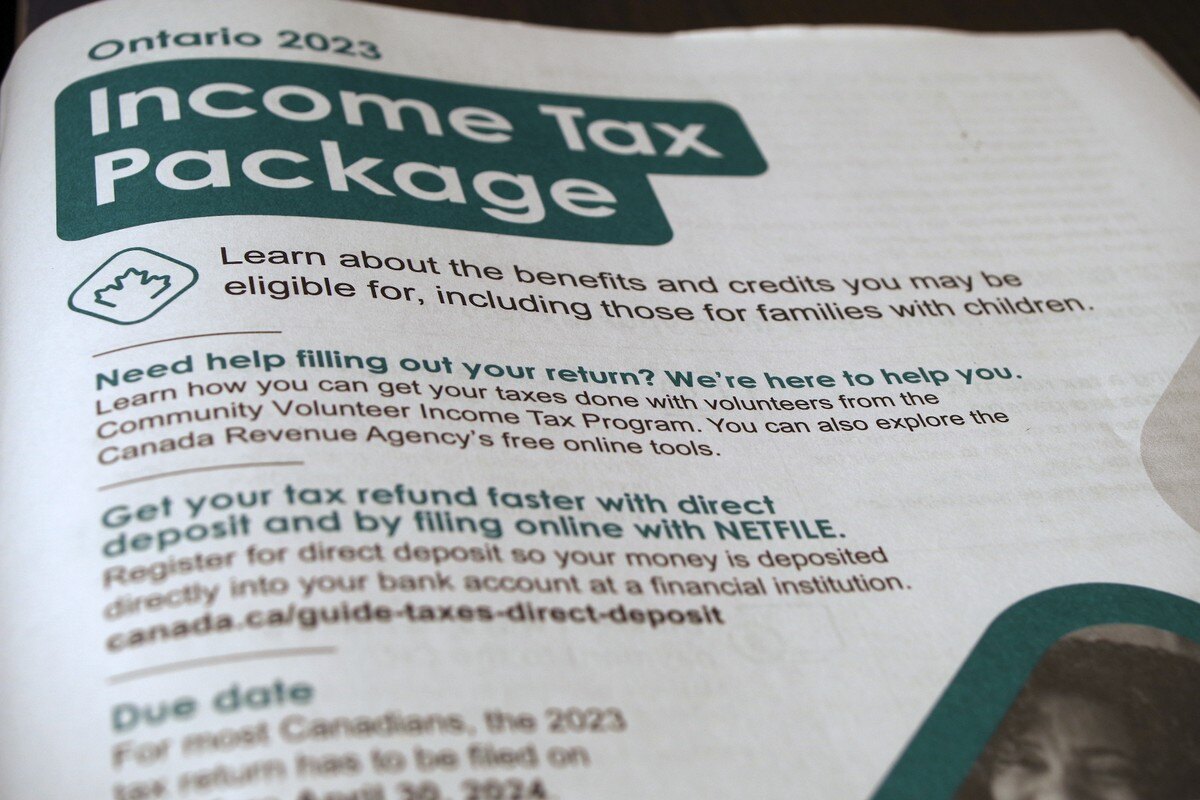

2023 Income Tax Package

You can get an income tax package online or by mail. Click here for more information.

Benefits Payment Dates 2024

Learn more about the payment dates for Pensions, OAS/GIS, HST, CCB, CCR and more.

Canada Revenue Agency (CRA)

General Information

- My Business Account Login

- How to Make a Payment to the CRA

- The CRA Enquiries Contact Centres are open Monday to Friday from 6:30 am to 11:00 pm ET, Saturdays from 7:30 am to 8:00 pm ET, and closed on Sundays.

Income Tax

- Learn about Personal Income Tax in Canada, including who should file a tax return, how to get ready for taxes, filing and payment due dates, reporting your income and claiming deductions and how to make a payment or check the status of a payment.

- Learn about Business or Professional Income Tax in Canada, including calculating income, and getting industry codes.

- Learn about Corporation Income Tax, including filing corporation income tax, finding tax rates, and getting information about provincial and territorial corporate tax.

- Learn about Trust Income Tax

- Learn about Partnership Income, including filing requirements for partnership information returns.

- Learn about International and Non-Resident Taxes, including information on tax treaties and how to file.

Tax Credits and Benefits for Individuals

- Canada Child Benefit

- The Canada child benefit (CCB) is administered by the Canada Revenue Agency (CRA). It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The CCB may include the child disability benefit and any related provincial and territorial programs.

- Learn about CCB Eligibility

- CCB Application

- GST/HST Credit

- The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs. You are automatically considered for the GST/HST credit when you file your taxes.

- Learn about GST/HST Eligibility

- GST/HST Application

- Learn about other Credits and Benefits that you may be eligible for.